| |

Spemann

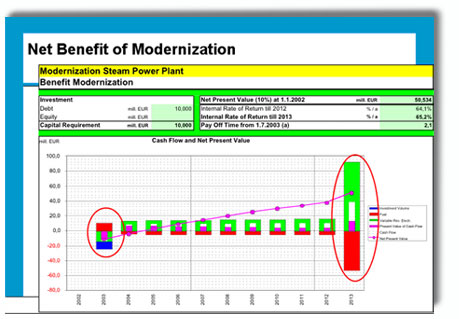

PG-ROI automatically

calculates the difference

of the two cash-flows by

subtracting one from the

other.

All revenues and costs that

are not affected by the

modernization cancel each

other out, remaining only

the components that have

changed. |

|

|

| Important

is the year of the modernization

(2003): the columns of revenues

and costs are reversed:

The loss of revenues during

the downtime is represented

by a negative green column

(negative revenue = loss

of revenue), on the other

side there are savings of

fuel costs, represented

by the positive red column. |

| |

| In

addition, there is the blue

column that represents the

price of the project (10

mEUR). |

| |

|

|

xx |

|

| |

After

the modernization ends, the plant

generates more revenues than without

modernization (higher output,

more operating hours) during several

years, while the fuel costs only

increase a little (the effect

of enhanced efficiency).

At the end of the lifetime (2013)

becomes obvious the result of

lifetime extension by six months,

so that the modernized plant generates

revenues and fuel costs during

additional 6 months. |

|