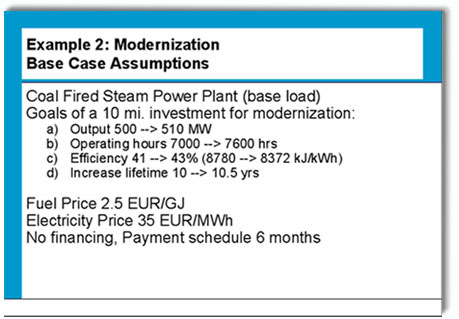

| This

example shows, how the comparison between

the two options "With Modernization“

and "No Modernization“ leads

to the net benefit of the Modernization. |

| |

| As

the project takes place in an existing

and operating plant, it is important

to include all effects of the downtime

period as well as the price for the

project itself. |

| |

| Spemann

PG-ROI automatically considers

all aspects that result from higher

output, higher efficiency, more operating

hours and even the increase of technical

lifetime. |

| |

| The

basic configuration and the market conditions

(fuel price and electricity price) are

known, no credit is drawn for financing

the 10 m Euro. |

| |

| |

| |

|

|

|

|

| |

Is

this project beneficial?

PG-ROI uses the method of Delta Investment,

which is the direct comparison between two

options: by subtracting the cash-flow of the

second option from the cash-flow of the first

option, Spemann PG-ROI automatically generates

the Delta cash-flow which represents the benefit

of the modernization itself. |

|