|

What

is Spemann PG-ROI for?

|

Calculate

Investment Figures

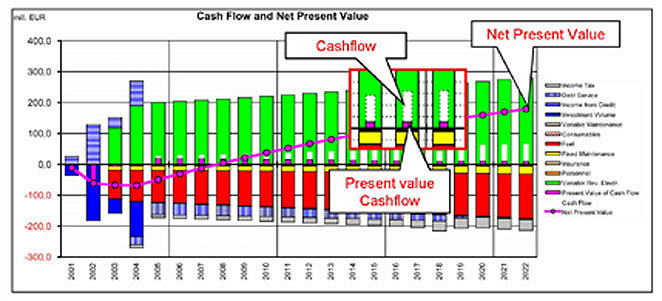

| Each

investment decision can be reduced – from

economic point of view – to its cash-flow

and the corresponding key investment figures. |

|

Spemann

PG-ROI calculates Net Present Value,

Internal Rate of Return, Pay-Off Time and

other figures, that allow are the basis for decision

making in each power plant investment. |

|

|

| |

Calculate

life cycle costs |

| |

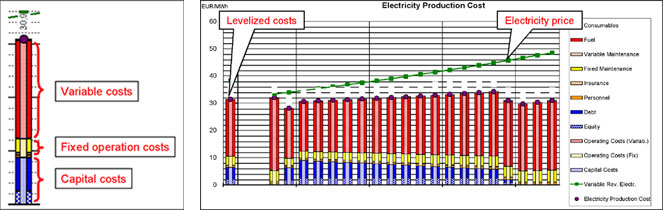

| The

life cycle cost of production determine the commercial

viability of the project, as load dispatchers and

power purchase agreements rely on them. The production

costs during peak hours, sometimes boosted by special

installations, may differ from the base load costs. |

|

Spemann

PG-ROI calculates live cycle costs of electricity

production over the service life with a monthly

resolution, divided into fixed, variable and financial

costs. |

|

| Each

investment should be justified economically. Given

a certain technical option and its corresponding

price, the key investment figures show the benefits. |

xxxxx |

Spemann

PG-ROI also offers a goal seek function,

which determines the maximum investment that is

justified under certain boundary conditions, for

example a pay-off time under three years |

|

| Each

provider faces the task to focus its limited resources

on the most promising projects, and to send out

the sales force to show she benefits to the potential

customers. |

xxxxx |

Spemann

PG-ROI is the specialized tool to screen

markets and projects, in order to find the ones

where highest benefit is expected. Then the same

PG-ROI can be used in the customer presentation

to show and discuss the benefits and close the deal

faster. |

|

| |

Compare

technical options |

| |

| Most

power plant projects have more than one technical

option, which affect the production, efficiency,

sales, costs and others. |

xxxxx |

Spemann

PG-ROI easily and quickly compares the

options, finds the superiority of one option over

another and opens the view on the best solution

for all involved parties.

|

|

|